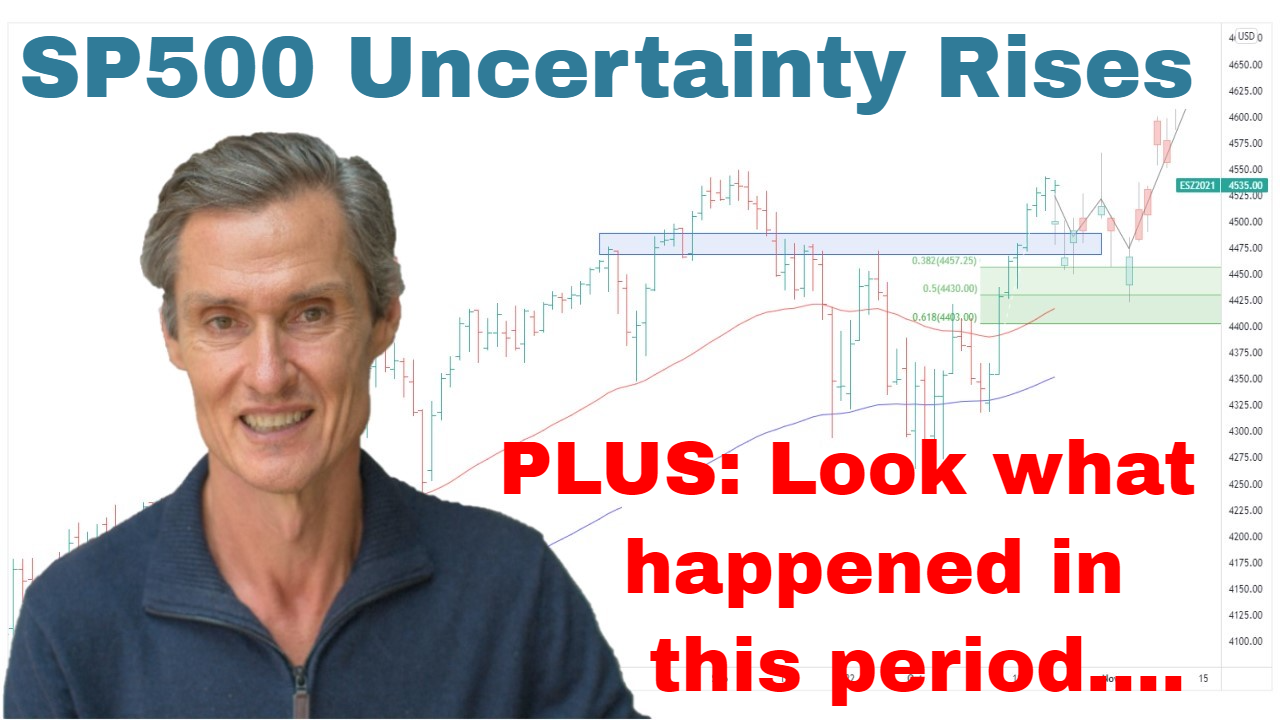

U.S. Technical Analysis: S&P 500 Pullback and Election Uncertainty | Episode 260

By Jason McIntosh | 1 November 2024

S&P 500: Navigating Pre-Election Volatility

The U.S. stock market, particularly the S&P 500, has experienced a notable pullback, reflecting growing uncertainty surrounding the upcoming U.S. elections. Let’s delve into the current market technical analysis and access it potential implications for investors.

Key Points:

- The S&P 500 has retreated to its 50-day moving average

- Similar downside moves observed in the Dow and NASDAQ

- Current pullback is approximately 3% from all-time highs

Understanding the Current Market Scenario

Election Uncertainty Impact

The looming U.S. elections have finally caught up with major U.S. indices, triggering a consolidation phase that was anticipated but occurred more rapidly than expected.

Maintaining Perspective

Despite the recent downturn, it’s crucial to maintain perspective:

- Limited Retreat: The S&P 500 is only 3% below its all-time high

- Normal Market Behavior: Pullbacks to the 50-day moving average are common in bullish trends

- Historical Context: Similar patterns have been observed in previous bull markets (e.g., 2020, 2016-2018)

Strategic Approach for Investors

Short-Term Caution

- Hold Off on New Buying: Unless exceptional opportunities arise, consider pausing new investments

- Risk Management: Exit positions hitting stop-losses and reduce overall risk exposure

- Cash Position: Maintain some cash reserves for future opportunities

Long-Term Perspective

- Benefit of the Doubt: Give the prevailing upward trend the benefit of the doubt

- Historical Patterns: Remember that pullbacks often stabilize and markets resume their upward trajectory

- Avoid Overreaction: Don’t become overly jittery at the first signs of a pullback

Historical Context: Lessons from Past Markets

2020 Market Behavior

The S&P 500 experienced multiple pullbacks to and below the 50-day moving average while maintaining an overall upward trend.

2016-2018 Market Dynamics

- Consistent New Highs: The market regularly set new all-time highs

- Frequent Pullbacks: Despite the uptrend, pullbacks were common

- August 2017 Example: Sharp pullback similar to current situation, followed by market stabilization and continued growth

Conclusion

While the current S&P 500 pullback and pre-election volatility warrant caution, historical patterns suggest that such movements are not uncommon in bull markets. Investors should maintain a balanced approach, managing short-term risks while keeping long-term trends in perspective. Remember, pullbacks often present opportunities for those prepared to capitalize on market dynamics.

****

Looking for the best ASX stocks to buy now?

Motion Trader‘s algorithms scan more than 2,000 ASX stocks daily in search of medium term investment trends. We then tell our members precisely when to buy shares. And most importantly, we tell them when to sell.

Try a no obligation FREE 14-day trial of Motion Trader, and see what an algorithmic trading approach could do for you.

****

Video Links

For reference to the topics discussed:

12:05 I didn’t expect the SP500 to do THIS

13:50 Could a familiar pattern be repeating?

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisory firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).