Algorithmic Trading Australia | What is Algo Trading and How to Do It

By Jason McIntosh | Published 22 February 2023

Algorithmic trading in Australia continues to grow in prominence. Once the domain of speciality investment firms, more and more private traders are embracing the benefits of algo trading and learning how to apply this professional technique themselves.

Algorithmic trading is a broad term and there are all sorts of algorithmic approaches. There are the high-frequency traders, mean reversion traders, and the trend traders. Algorithmic traders also operate over a variety of timeframes and markets, so there isn’t one specific definition.

One common factor in all algorithmic approaches is that they allow traders to program their trading style into a computer, and then the computer consistently applies their approach.

Algorithms also give a trader the ability to cover much more ground. Rather than look at each stock individually, algorithms can quickly analyse an almost limitless number of stocks. This can help identify more opportunities and calculate entry and exit points with more consistency.

For example, I’m a trend following trader. I look for medium term investment trends in ASX and SP500 stocks. Early in my career, I’d go through the charts one-by-one. Now I analyse the entire ASX or NYSE in a matter of minutes.

Algorithms allow a trader to explain to a computer what to do. The computer then goes and does the work quickly and efficiently.

For instance, I’ll tell the computer (via algorithms) that I wanted to identify trends in ASX or SP500 stocks. I’ll say how I want the computer to identify trends with a set of rules (using moving averages and price breakouts). I’ll also explain how I want to exit stocks, depending on whether they are in profit or a loss.

I’ll then tell the computer to spread risk across my portfolio. Minimising the potential for loss and protecting capital is a hallmark of just about every successful trader.

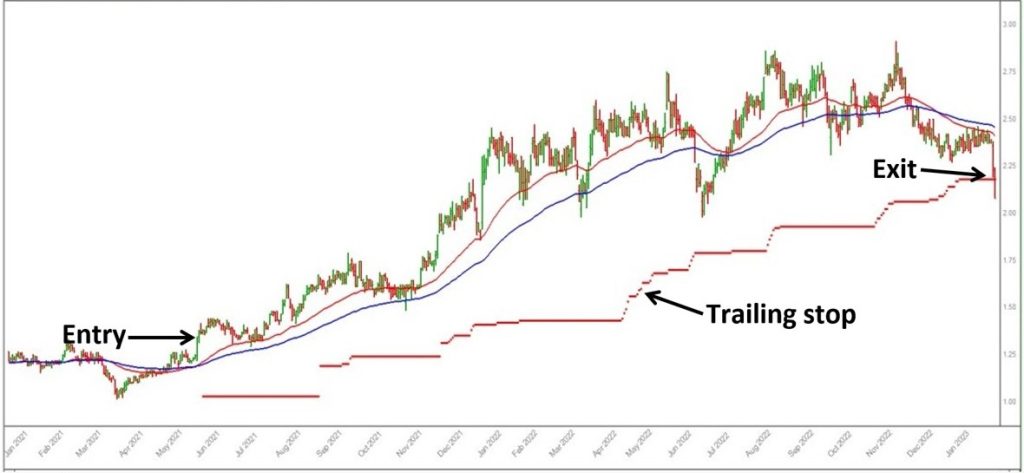

Here’s an example:

This is a hypothetical trade in OFX Group [ASX:OFX] — an online foreign exchange payments and transfers business.

My daily algorithmic scans identified upward momentum (using 50 and 100-day moving averages and a breakout strategy). The algorithms then calculated a trailing stop over the course of the trade. Once the calculated exit level was hit, the trade came to an end.

Many people struggle to hold a position in a company like OFX. Numerous corrections and zig-zagging price action often result in frayed nerves and an early exit. An algorithmic approach can help avoid second guessing the market’s next move. Simply calculate the levels and follow the rules.

Algorithms can also provide a level of precision that few traders can manage on their own. This helps them act with more consistency and greater confidence.

The biggest challenge for many traders is inconsistency. They’ll have an idea, and they’ll buy some shares. But if the stock falls in value, they’ll often jump to another approach. They end up with a hotchpotch of strategies and guesswork, and the overall outcome is typically poor.

Another issue for many traders is that they don’t know what’s working and what isn’t working. An algorithmic approach is clear-cut. You know exactly what causes each entry and exit. This can help a trader do more of what works, and less of what doesn’t.

If you’d like to know more about algorithmic trend following, and if you want to learn about the type of entry and exits rules many professionals use, then I have a series of videos and articles that could help.

I’ll also show you how a trend following algorithm applies rules in real-time.

You can get all the details here

Jason McIntosh | Founder, Motion Trader

Jason’s professional trading career began over 3 decades ago. He’s a founder of two stock advisor firms, a listed funds management business, and has helped thousands of investors navigate the stock market. Click here to read Jason’s incredible story of, at age 20, sitting alongside some of the world’s greatest traders (and the life changing experience that came with that).