Perpetual (ASX:PPT) Could Be the Next Big ESG Story

Jason McIntosh explains why Perpetual Ltd [ASX:PPT] could be a leading ASX stock to buy now (July 2021). The company is expanding its global footprint by purchasing a specialist ESG investment firm, and the share price could rise significantly from current levels.

I often cover smaller a lot of less well-known companies. These are often the most interesting opportunities with the greatest growth potential.

But opportunity also exits in the bigger stocks.

Chances are you know the name: Perpetual. The diversified financial services company has a market cap of around $2.2 billion, which puts it at the lower end of the ASX 200.

Perpetual is one of Australia’s largest wealth managers. The company also operates internationally, with offices in the United States, UK, Europe, and Asia.

Financially, the company appears to be doing well…

Total assets under management grew 6.8% in the March quarter to $95.3 billion. This is split between the international arm $71.6 billion (up 8%) and the local business $23.7 billion (up 4%).

The company says growth is due to positive market returns and strong investment performance.

Perpetual has recently expanded its global footprint with two acquisitions: a 75% interest in US-based manager Barrow Hanley, and specialist ESG investment firm — Trillium.

[ESG stands for Environmental, Social, and Corporate Governance]

The company say that Barrow Hanley establishes a platform to build a world class distribution capability. It will also help to accelerate global growth and investment capabilities.

The acquisition of Boston based Trillium is particularly interesting. Perpetual describes the growth of ESG as a primary mega trend, with over $7.2 trillion of ESG assets under management in Europe.

In Australia, assets under management for responsible investing has surpassed $1 trillion, or 36.7% of total professional managed assets. Make no mistake, this is a big market.

Trillium has recently launched two products in Australia: The Trillium ESG Global Equity Fund and the Trillium Global Sustainable Opportunities Fund.

Perpetual says that Trillium is a pioneer in ESG investment and an industry leader. I believe the purchase highlights PPT’s active focus on increasing its exposure to the growing ESG theme.

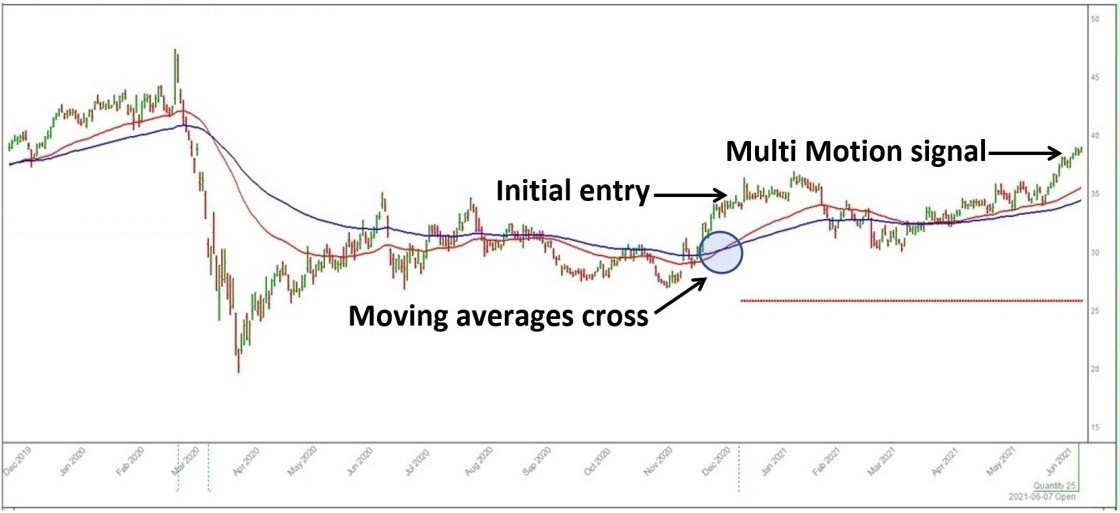

I first sent a buy signal to members of my Motion Trader service last December at $34.02. The stock recently triggered a second buy signal at $38.89 via my Multi Motion service.

If you don’t know, Multi Motion provides up to 10 entry points per stock. The aim is to provide multiple opportunities to buy stocks that are in up-trends.

Perpetual has an interesting chart profile.

Let’s have a look:

Notice how the moving averages turned higher just before the initial entry. The shares then rallied to a new high before a correction set in. The correction then lasts for two months.

This type of price action is reasonably common. Once a stock breaks above its moving averages, it will often pull back and re-test the averages before the emerging up-trend continues.

I have another chart to show you:

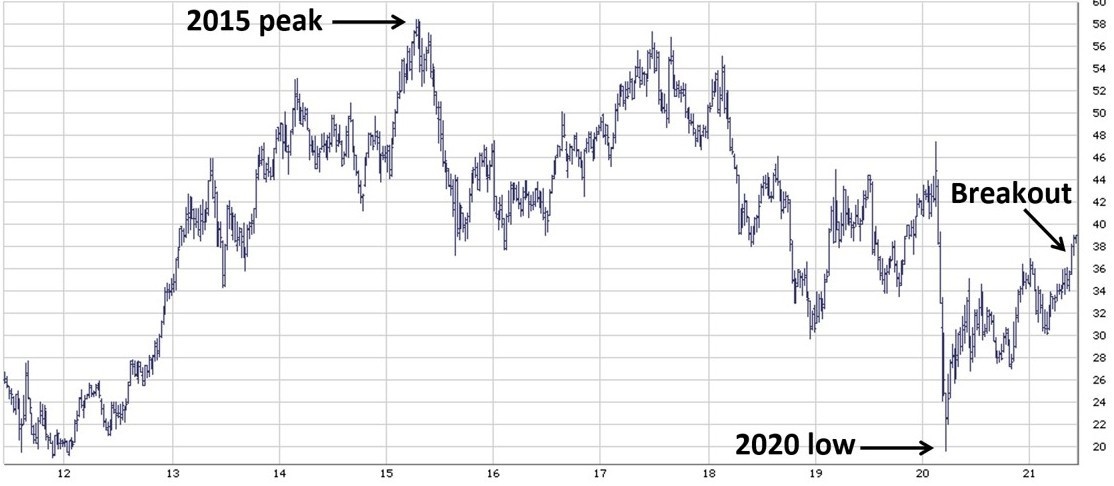

This is Perpetual’s 10 year price history.

After hitting a peak of $58.48 in 2015, the shares began a lengthy bear market. The end result was a crushing 66% fall. As I often say, having an exit strategy is so important.

I believe last year’s low marks the end of that decline. The recent rally above January’s high adds further weight that a recovery is underway and that higher levels are likely.

Finally, the company currently has a dividend yield of 3.5%.

Where to invest now?

Looking for ASX stocks to buy now, as well as off the radar ideas most people don’t know? Our algorithms scan the market daily for medium term investment trends. We then tell our members precisely when to buy. And most importantly, we tell them when to sell.

If you’re ready to get started, try a no obligation one month trial of Motion Trader, and see what an algorithmic trading approach could do for you.