Could Uranium be the Next Green Play?

Jason McIntosh discusses the potential for a uranium bull market due to a shift to green energy and a shortfall in uranium supply. This interview appeared on Ausbiz on 24 December, 2020.

Host: Uranium has been recovering from a decade long bust. But is next year the year to buy up the local uranium stocks and potentially some ETFs as well? Jason, what’s the investment case underpinning uranium?

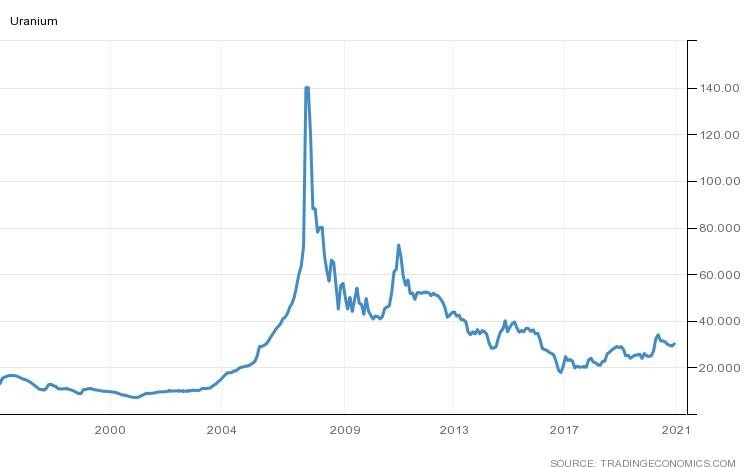

Jason: Uranium is a really interesting situation. It’s been in a decade long bust. If you go back to 2004, it was trading at around $10 a pound, and by 2007 it was up to $140 a pound. So that’s a huge boom. Then the GFC came along, and the price plummeted. Uranium got down to around $40 a pound.

From there, we saw a recovery into 2011 with the price rising to $70 a pound — although it was still about 50% below the previous highs. What happened next was the Fukushima nuclear accident. At the time, Japan had something like 54 reactors, and over the next two years, they shut the whole lot down. I believe that 12 have been permanently closed and a lot of other reactors still haven’t come back online. So, there was a big contraction in demand.

At the same time, there was a supply shock. The world’s largest uranium producer, Kazakhstan, were ramping up production, and the world’s largest listed company Cameco, were bringing new supplies online. We talk about a perfect storm, and this was pretty much one of those times — demand and supply were both being hit at the same time.

The combined hit to demand and supply devastated the industry. From something like 500 uranium plays in 2007, there’s currently said to be around 50. And some of those aren’t investable because they’re state-owned entities.

So that’s the situation we have now. Uranium is a small and rather unfollowed segment of the market. And there’s a real demand-supply story building. Demand is forecast to increase over the next 10 to 20 years. But supply currently isn’t there to meet that demand. So we’ve got this structural supply deficit in the market.

Now, the way to naturally combat this is bring on new supply. This could be done by scaling up production and opening new mines. But with the price where it’s been for much of the last decade, it hasn’t been economic to do so. And if you look at what a lot of the miners have been doing, they’ve actually been cutting production and mothballing mines. This is because mining isn’t economic at current prices. Around half the mines aren’t profitable, so it’s not a productive backdrop for bringing on new supply.

So that’s the challenge. Where will the utility companies that use uranium source their supply? And then you look on the demand side. Just this year, global nuclear output has surpassed pre-Fukushima levels. And you look at where that output is coming from. It hasn’t come from Japan because a lot of those reactors are still shut down. It’s coming from new reactors opening.

The World Nuclear Energy Association say there’s something like 52 reactors currently under construction around the world, worth about half a trillion dollars. There are another 450 or so which are either planned or proposed. Now, a lot of these may not come online. But even if a portion of them do, there’s a lot of potential demand coming in, and the supply side isn’t currently equipped to meet that demand.

It’s important to remember that this is a relatively small industry. If the investment dollars start coming through, this opens the potential for some significant gains.

Host: So Jason, let’s go and get to some of those companies that the momentum indicators have gone and triggered on your platform. Now a lot of people when they think of uranium here in Australia think Paladin Energy (ASX:PDN). Where is that at the moment on your list?

Jason: Paladin’s a really interesting stock. In 2004 it was trading below 10 cents. Then by 2007 it got to near $10 before falling back to below 10 cents. This isn’t so much a story of a stock imploding, it’s a story about an industry imploding. Paladin’s situation is quite common when you look at the share prices of uranium stocks globally.

Paladin is in the All Ordinaries, but with a $500 million market cap, it isn’t in the ASX300. Over the last few years, we would have been talking about how this was a disaster stock. It’s really only this year that Paladin’s share price is starting to get some upward momentum. The stock is 170% above its pre-COVID high, but it’s coming off a very low base. People may look at Paladin and think they’ve missed it. But it’s still at low levels compared to where it’s been in the past.

Paladin Energy (ASX:PDN) has a mine in Namibia, which is a uranium friendly jurisdiction. They also have a large resource base in Queensland and WA. You can’t mine uranium in those states at the moment. But there’s an interesting green argument to uranium over the next few years.

When we talk uranium or nuclear, I think a lot of people instantly think either weapons or accidents, and they think of Chernobyl or Fukushima. So uranium’s been the bad guy on the block for a long time. But when you look at the facts, it’s actually one of the safest, cleanest, and most reliable sources of energy. If we’re going to have a good crack at reducing emissions over the next couple of decades, there’s an argument that you do come back to nuclear, because at the moment, coal is the main source of electricity generation.

Solar and wind probably aren’t going to take over from coal anytime soon. So the potential is there for nuclear to come through. I think that Paladin is well placed, and if we do see that change of sentiment towards nuclear, then there is the potential for its resources in Queensland and WA to come into play.

Host: Jason we’re starting to run a little bit short on time, but is there any other way that investors out there can go and play the uranium trade? Are there any names or ETFs that have popped up on your radar?

Jason: Just quickly, a stock which recently came up in my algorithmic scans is a company called Deep Yellow (ASX:DYL). It’s an ASX-listed company and they have a resource base in Namibia, which is uranium friendly.

Another way to do it is through an ETF. Now there’s no ETF’s on the ASX. But there is one on the New York Stock Exchange. It’s only got a market cap of $40 million, which is surprising for that market. But that’s just the space that we’re in with uranium. It’s called North Shore Global Uranium Mining (NYSE:URNM). It’s got a portfolio of around 29 stocks. Paladin and Deep Yellow are in the portfolio, as is Cameco, the largest listed producer.

I think that North Shore Global Uranium Mining ETF is a good way to get exposure over the whole industry. I’ve got an investment in this company myself. I think it’s a very positive asymmetric risk-reward trade. Because it’s so down and out, I believe the risk is relatively low, but the upside potential is substantial over the next few years.

Looking for more “off the radar” stock ideas?